Mastering Crypto Trading: Proven Strategies

In recent times, the world of cryptocurrency trading has witnessed a surge in popularity, drawing people from various walks of life who are keen to explore its potential for financial gain. Yet, achieving success in this dynamic market demands a carefully devised strategy and a profound grasp of tactics to effectively navigate the hurdles and optimise earnings. This blog will provide an in-depth exploration of cryptocurrency trading, shedding light on effective strategies and tactics that can benefit both newcomers and seasoned traders on their path to achieving prosperity.

Understanding the Basics of Cryptocurrency Trading

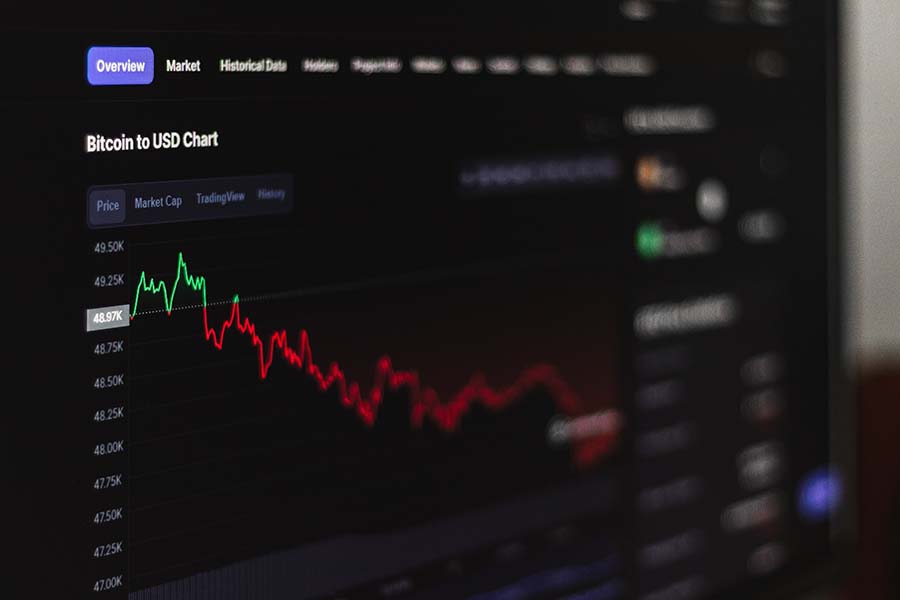

Before diving into the strategies and tactics, it is crucial to grasp the fundamentals of cryptocurrency trading. Unlike traditional stock markets, cryptocurrencies operate 24/7, making it essential to stay updated with market trends and news. Additionally, the high volatility of cryptocurrencies demands constant vigilance and the ability to make quick decisions based on market fluctuations.

Cryptocurrency trading encompasses the acquisition and disposal of digital assets or cryptocurrencies through diverse exchange platforms. These digital assets are decentralised and function on blockchain technology, ensuring both transparency and security in transactions. To excel in cryptocurrency trading, it’s crucial to grasp the core technology and the factors that exert influence on their valuation.

Developing a Solid Trading Strategy

To excel in cryptocurrency trading, a well-defined strategy is essential. Here are some critical steps to consider:

Educate Yourself

Begin by thoroughly understanding the cryptocurrency market and the specific cryptocurrencies you intend to trade. Please familiarise yourself with the technology behind these digital assets, their potential applications, and the factors influencing their value.

Study the whitepapers and documentation of different cryptocurrencies to gain insights into their technology and purpose.

Keep yourself informed about the most recent news and advancements in the cryptocurrency sector by relying on trustworthy sources.

Become a part of online communities and forums where you can interact with seasoned traders and gain valuable insights from their experiences.

Set Clear Goals

Establish your trading objectives, whether they entail short-term profits or long-term investments. Having distinct goals will serve as a compass, directing your decision-making and ensuring your trading efforts align with your intended results.

Determine the amount of capital you are willing to invest in cryptocurrency trading.

Determine if you prefer to concentrate on day trading or opt for long-term investment strategies.

Set realistic profit targets and timeframes for achieving your goals.

Determine Risk Tolerance

Assess your risk tolerance level, crucial in shaping your trading strategy. Consider your financial standing, time commitments, and emotional resilience. This evaluation will help you identify your preferred trading style, whether conservative, moderate, or aggressive.

Assess your financial circumstances and figure out the amount you can risk without impacting your overall financial stability.

Consider how much time you can spend monitoring the market and executing trades.

Understand your emotional responses to market fluctuations and identify ways to manage them effectively.

Choose the Right Exchange Platform

Selecting a reputable and secure cryptocurrency exchange platform is vital for successful trading. Conduct thorough research regarding the platform’s fees, security measures, liquidity, and user experience. Opt for platforms that offer a wide range of cryptocurrencies and helpful trading tools.

Compare the fees charged by different exchange platforms and choose the one that aligns with your trading budget.

Verify that the platform boasts strong security protocols, including two-factor authentication and secure cold storage for your funds.

Assess the platform’s liquidity, as higher liquidity allows for faster execution of trades.

Look for additional features and tools the platform offers, such as charting tools, order types, and educational resources.

Utilise Fundamental and Technical Analysis

For well-informed trading choices, blend fundamental and technical analysis. Fundamental analysis encompasses assessing the core elements influencing a cryptocurrency’s value, including its technology, team, and adoption rate. In contrast, technical analysis hones in on historical price patterns and market trends to forecast forthcoming price shifts.

Use fundamental analysis to assess the potential of a cryptocurrency by analysing its technology, partnerships, community support, and adoption rate.

Utilise technical analysis methods, like chart patterns, trend lines, and indicators, to pinpoint suitable entry and exit points for your trades.

Consider using tools and platforms that provide real-time market data and analysis to enhance your decision-making process.

Implement Risk Management Strategies

In cryptocurrency trading, the key to success lies in efficient risk management. Establish well-suited stop-loss orders and take-profit levels to mitigate potential losses and secure gains. Enhance your portfolio’s resilience by spreading your investments across various cryptocurrencies, thereby lessening the impact of a single asset’s underperformance.

Determine the percentage of your portfolio that you are willing to risk on each trade.

Set stop-loss orders at levels that align with your risk tolerance and trading strategy.

Take profits at predetermined levels to secure gains and avoid market fluctuations.

Consider diversifying your portfolio by investing in cryptocurrencies from different sectors or with varying market capitalisations.

Tactical Approaches to Cryptocurrency Trading

To enhance your trading skills and increase the likelihood of success, consider implementing the following tactics:

Start with a Demo Account

If you are new to cryptocurrency trading, begin with a demo account provided by many exchange platforms. This lets you practice trading strategies without risking real money, helping you gain confidence and refine your skills.

Familiarise yourself with the trading platform’s interface and features.

Experiment with different trading strategies and observe their outcomes.

Analyse your trades and identify areas for improvement before transitioning to live trading.

Follow Market Trends

Stay informed about the latest news, regulatory developments, and market trends. Subscribe to reputable cryptocurrency news sources and join online communities to engage with experienced traders. This knowledge will enable you to identify emerging opportunities and potential risks.

Regularly read news articles and updates from reliable sources to stay updated on industry trends.

Monitor social media channels and forums to gauge market sentiment and identify potential trading opportunities.

Participate in online discussions and seek advice from experienced traders to gain valuable insights.

Keep Emotions in Check

Emotional decision-making frequently results in unfavorable trading results. Steer clear of impulsive actions motivated by fear or greed. Instead, ground your choices in thoughtful analysis and adhere to your pre-established trading strategy.

Develop a trading plan that outlines your entry and exit strategies, risk management rules, and profit targets.

Follow your plan consistently and avoid deviating from it based on short-term market fluctuations.

Maintain discipline and control your emotions, even during periods of market volatility.

Implement Stop-Loss Orders

Utilise stop-loss orders to automatically sell a cryptocurrency if its price drops below a certain level. This limits potential losses and helps protect your investments from unexpected market downturns.

Set stop-loss orders at levels that align with your risk tolerance and trading strategy.

Regularly review and adjust stop-loss levels based on market conditions and price movements.

Use trailing stop-loss orders to secure profits as the price of a cryptocurrency increases.

Practice Proper Risk Management

Only invest what you can afford to lose, and allocate a specific portion of your portfolio for cryptocurrency trading. Avoid getting caught up in FOMO (Fear Of Missing Out) and take a disciplined approach to risk management.

Determine the capital you will allocate for cryptocurrency trading, considering your financial situation and risk tolerance.

Avoid investing all your capital in a single cryptocurrency and diversify your portfolio to spread the risk.

Review and rebalance your portfolio to align with your risk tolerance and investment goals.

Keep a Trading Journal

Maintain a trading journal to record your trades, strategies, and outcomes. Analysing past trades can provide valuable insights into your strengths and weaknesses, allowing you to refine your approach and learn from successful and unsuccessful trades.

Record the details of each trade, including the cryptocurrency traded, entry and exit points, and reasons for entering or exiting the trade.

Evaluate the outcomes of your trades and identify patterns or trends that can inform your future trading decisions.

Continuously update and review your trading journal to track your progress and make necessary adjustments to your strategies.

A Perfect Strategy & Tactics: CRYPTOULTIMATUM – Trade Like a Crypto Whale

Discover the Strategies and Tactics Employed by Crypto Whales to Multiply Your Bitcoin! A comprehensive training program has been designed to assist absolute beginners (even those lacking prior skills or experience) in achieving substantial profits quickly through crypto trading. Unveiling the covert strategies and tactics employed by the most successful crypto investors for added earnings. If you’ve never ventured into crypto trading, now is the perfect moment to start; it’s not too late! Trading crypto can yield significantly higher returns than simply holding it.

Click here to access all the details about the system:

Conclusion

Trading in cryptocurrency can be highly profitable, but it requires a strategic mindset and a thorough understanding of the market. By developing a solid trading strategy and implementing tactical approaches, you can navigate the challenges and increase your chances of success. Stay informed, manage your risks effectively, and continuously refine your trading skills. With dedication and patience, cryptocurrency trading plus the perfect strategy and tactics can become a rewarding venture.

Check out our other related posts if you enjoyed this one.

- The Rise of Collaborative Robots: Transforming Industries

- Unmasking Cyber Secrets: The Art of Deception Revealed!

- Decoding Cyber Threats: The Social Engineering Menace

- Unlock the Ultimate Quest: Ready Player One’s Audio Adventure!

- Revolutionising Wellness: Metaverse Therapy Unleashes Mental Liberation!

- Code Mastery Unleashed: Transform Your Skills with Clean Code by Robert C. Martin! 🚀

- Top Must-Have Tech Gadgets for Kids – Unbelievable Fun!

- Unveiling Ethereum 2.0: Advancements & Impact

- AI Transforms E-Commerce: A Digital Revolution

- AI’s Robotic Revolution: Trends & Tomorrow

If you enjoyed this blog post, subscribe for updates and stay tuned for our latest insights.

Help your friends and colleagues stay informed about the newest insights on business, marketing, finance, lifestyle, and society by sharing our blog content through Facebook, Twitter, Pinterest, LinkedIn, email, or WhatsApp links below. We can create a knowledge-sharing community and empower one another to accomplish and experience our objectives.

FAQ

What is cryptocurrency trading?

Cryptocurrency trading involves buying and selling digital assets or cryptocurrencies on various exchange platforms. These digital assets are decentralised and operate on blockchain technology, which ensures transparency and security in transactions.

How can I develop a solid trading strategy?

To develop a solid trading strategy in cryptocurrency trading, follow these key steps:

Educate yourself about the cryptocurrency market and specific cryptocurrencies.

Set clear goals, including the amount of capital you are willing to invest and the time frame for achieving your goals.

Determine your risk tolerance level and preferred trading style.

Choose a reputable and secure exchange platform.

Utilise fundamental and technical analysis techniques.

Implement risk management strategies such as setting stop-loss orders and diversifying your portfolio.

What are some tactical approaches to cryptocurrency trading?

To enhance your trading skills and increase the likelihood of success, consider implementing the following tactics:

Start with a demo account to practice trading strategies without risking real money.

Stay informed about the latest news, regulatory developments, and market trends.

Keep emotions in check and base your decisions on well-reasoned analyses.

Implement stop-loss orders to limit potential losses.

Practice risk management by investing only what you can afford to lose and diversifying your portfolio.

Keep a trading journal to analyse past trades and refine your approach.

What are the key factors to consider when choosing a cryptocurrency exchange platform?

When choosing a cryptocurrency exchange platform, consider the following factors:

Compare the fees charged by different platforms and choose one that aligns with your trading budget.

Ensure that the platform has robust security measures in place, such as two-factor authentication and cold storage for funds.

Assess the platform’s liquidity, as higher liquidity allows for faster execution of trades.

Look for additional features and tools the platform offers, such as charting tools, order types, and educational resources.

Credits

Featured photo by Behnam Norouzi on Unsplash.

Featured product and service – CRYPTOULTIMATUM – Trade Like a Crypto Whale.